How To Find New Businesses To Invest In

Investing in The Hereafter: How To Discover Pocket-size Companies To Invest In

The world of investing is a volatile one at the best of times – non least when it involves pinning your hopes on the successful scaling of a small company that'southward withal to fully constitute itself.

The movie Wolf of Wall Street went some way in projecting a frightening epitome of sleazy penny stock brokers trying to sell worthless shares in startups that accept their head offices located in a garden shed.

Funny it might be, but it's not an authentic portrayal of small company investment – well, nigh of the time.

Today, the nearly effective way of investing in a promising small company is through the use of modest-cap stocks. These refer to the stocks of a publicly-traded visitor that has a marketplace capitalization that ranges from $300m to $2 billion – hence the use of the discussion 'cap.'

This means that the definition of a 'pocket-size' company is subjective but loosely conforms to this capitalization band. Considering they accept significantly more than room to grow compared to companies that have already established themselves, investing in small-cap stocks can be highly lucrative. However, there'southward plenty more than danger of said businesses folding at the same time.

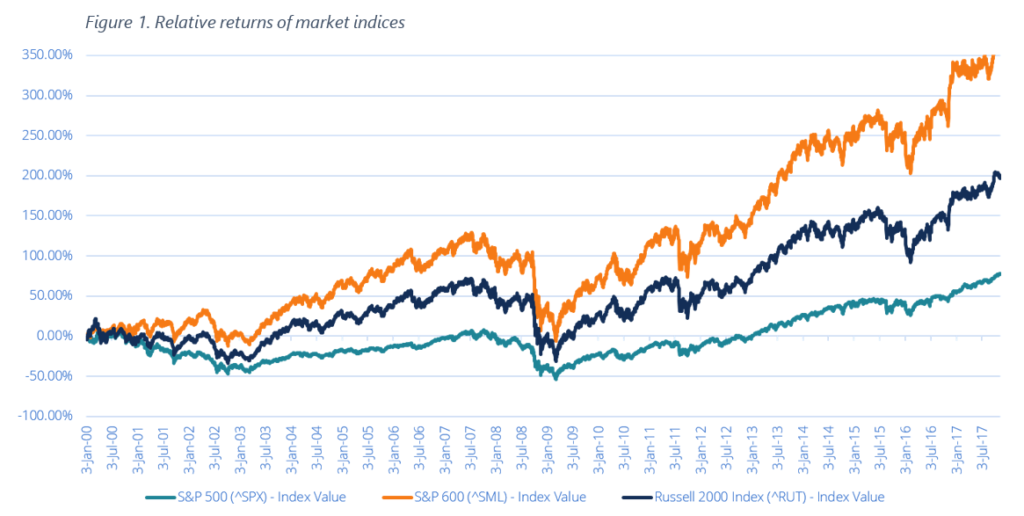

(Modest-cap indexes of South&P 600 and Russell 2000 Index testify significantly higher growth potential compared to the larger cap index of S&P 500. Image: CFI )

In the chart higher up , we tin see a articulate correlation between the returns of the small-cap markets (S&P 600 and Russell 2000 Index), as opposed to the larger cap marketplace of Southward&P 500.

This makes the act of investing in smaller companies significantly more lucrative for investors who choose their businesses wisely. Simply how easy is information technology to discover the right pocket-size visitor to invest in? And is it possible to maximise your chances of making a profit? Hither's a deeper look at how to invest accordingly into the dynamic globe of the smaller scale public companies:

Pocket-sized-cap markets vs penny stocks

It'due south worth taking a deeper expect at the differences between modest-cap stocks and the aforementioned penny stocks. While most small-cap stocks actually operate as penny stocks, their share value can easily ascension beyond the $v cutting-off price for penny stocks. Too as this, small-cap stocks bask a greater level of liquidity every bit opposed to their market counterparts.

Look out for volatility

Market volatility tin be a great ally for minor-cap investors. If we take the time to learn our lessons from previous periods of high-volatility , the unpredictable nature of the market today volition likely lead to another 'baby-out-with-the-bathwater' effect where low trading volumes punish price disproportionately for smaller companies.

Although it sounds like an incredible risky melting pot of market doubtfulness, at that place can exist some great value opportunities for investors who have bided their time in waiting for the right small-cap dips.

Use the right tools

There are plenty of places where you can find scores of data on the share information of smaller companies. Near online tools come costless of charge when it comes to monitoring small-cap stocks, and companies similar CNBC.com possess an accessible costless stock screener that tin can easily exist customised.

Considering of the massive array of metrics that come up with stock monitoring tools, there's enough of advice out there for users who would like to know exactly where to notice their best bets for increased revenue.

Co-ordinate to CNBC, some of the most constructive ways of identifying the best small-scale companies to invest in tin can exist plant by using tools to search for stocks with a market cap of less than $500, or a year-over-year revenue growth of over ten%, or i-year EPS growth of more than 15%.

It's also worth searching the minor-cap markets for companies with a P/Eastward ratio of 15 or less, and stocks with coverage of significantly fewer analysts – hidden gems are the best mode of leveraging a big payout.

Utilising these criteria, at that place's a relatively good chance of identifying a few potent candidates for deeper analysis. Although it'south important that these investments conform to your personal goals and nugget allotment approaches.

There are as well numerous tools out at that place that tin exist bought for a competitive subscription rate that could greatly benefit users who may want to sit on a various portfolio of small businesses. Some of the ameliorate stock comparison tools are capable of providing aggregated performance scores that reverberate various multiples.

Gauge interest

It's of import to critically analyse why a specific small company may be attracting interest. Attempt running a few searches of the company proper name and gauging why and so many investors are sitting up and taking note.

If the company'due south web profile appears to be low compared to that of ofter similarly positioned small companies and so at that place's a gamble that few investors will be in a position to learn of its ongoing scaling until at to the lowest degree the side by side release of a quarterly earnings report, of the Securities and Exchange Commission'south Grade 8-Thousand – with the letter being filled out simply in the case of a sizeable change that volition considerably enhance the company'south profit margins.

Speculation can ultimately be a peachy way of drawing in investors, but it's of import to know if further involvement is likely after y'all accept the plunge and invest. Companies that are better at generating buzz tend to perform well in converting interest into shares.

Look closer to home

There can exist great value plant in looking into stocks that come from local businesses as opposed to companies that operate over one k miles away. Through local news outlets, information technology'due south possible to keep beside of big developments within local businesses ahead of the stories reaching the rest of the country. Your local business could exist about to unveil a new development, partnership or product before an eight-K is released or other investors accept a risk to join the bandwagon.

This isn't necessarily a flawless approach of class, and there'south plenty of danger surrounding confirmation bias in this area. Local businesses – particularly those based in labor-intensive industries – are typically front-and-centre in the minds of local residents, and tin perpetuate familiarity bias – leaving more than locals with too many shares and a significant lack of portfolio diversification.

Nevertheless, if you heed these warnings, and dedicate enough attention to pursuing the promise of new local businesses, it's possible that you could effectively tap into an exciting new investment that the balance of the marketplace is notwithstanding to know nigh.

Source: https://daglar-cizmeci.com/how-to-find-small-companies-to-invest-in/

Posted by: jacksonwasce1943.blogspot.com

0 Response to "How To Find New Businesses To Invest In"

Post a Comment